What Continect Is Argentina Located on Who Contols the Price of Beef in Argentina

- Research

- Open Access

- Published:

Argentine regime policies: impacts on the beef sector

Agricultural and Food Economic science book 5, Article number:1 (2017) Cite this article

Abstruse

Beefiness is a staple food for Argentine consumers, and although the country has been a major exporter, the highest proportion of beef product is consumed in the domestic marketplace. With rising aggrandizement rates in the last 5 years, and given the beef prices' potent weight on the composition of the Consumer Price Alphabetize, the Argentine government began taking measures to control information technology. They initially forced cost agreements with members of the marketing and production concatenation and concluded up with a total ban on exports. The results were non as expected and caused serious distortions at different levels of the beef chain. This study aimed to determine whether the bear on on some economic and production variables would have been different without such intervention. A VAR model was estimated in order to compare the observed behavior with intervention measures and estimated predictions with a theoretically free market.

Background

The agri-food sector is very important to the Argentine economy, generating near 30% of the Gross Domestic Product (Gdp) and 50% of its full exports (Obschatko 2012). The beef sector has been an outstanding component, generating 22% of the agricultural sector gross domestic production and 6% of the total manufacturing production (INDEC 2012).

Generally, effectually three quarters of beef production has been consumed domestically, with the remaining volumes exported. It allowed positioning the state as one of the larger exporters in the world market state of affairs, which changed in the last years equally a result of several government measures. While beef exports between the years 1995 and 2005 averaged 15% of total beef production, the participation was reduced to 7% in 2014 (MINIAGRI 2015). From being the world'southward third largest beef exporter, with 775,000 tons in 2005, the land descended to the 11th place, with 197,000 tons in 2014, well backside its neighbors, Brazil, Uruguay, and Paraguay (MINIAGRI 2015; COMTRADE 2016).

In the domestic market place, beef is considered a staple food and as such a primal component of the family consumption basket; therefore, it monopolizes regime attention both to ensure its availability to the entire population and to sentinel the impact it has on consumer price changes. Since beef carries a 4.v% weight in the Consumer Toll Alphabetize (CPI), the government became worried. This led it to take several improvised and precipitous curt-term policy measures to keep prices under control since 2005.

Following the 2002 devaluation and economic crisis, the beef sector began a dull recovery. Initially, livestock and beef prices remained stable, but later, a sustained domestic and foreign need pushed them upward. Domestically, beef demand got stronger basically as a result of an improvement in the population existent income. Internationally, it was fueled by some emerging countries growth, large purchases past Russia and Chile, and the crisis of other suppliers from the mad cow disease. As a effect, there was an excess of beef demand which was quickly reflected into domestic prices. Nevertheless, by 2005, the exchange charge per unit had tripled while average beef prices had only doubled (Melitsko et al. 2012).

The stiff incidence on the CPI and the accelerating inflation rates moved the government to intervene actively. Initially, in March 2005, government carried out a price agreement with the individual sector attempting in vain to curb the price rise; in August, information technology imposed a minimum slaughter weight for alive animals with objective to increase the supply of heavier animals; in November, the target was to restrict strange sales, elevating export taxes to 15%, and eliminating the consign reimbursements of indirect taxes (5%). In Jan 2006, an export registry system (ROE) Footnote 1 was created. The government function in accuse of administering the organization (ONCCA) Footnote two was given the ability to extend an export authorization for each shipment, as a precondition to the custom clearance. Delays and arbitrary objections were afterward used as ways to interfere and discourage operations. Furthermore, in March 2006, beef exports were initially banned for 180 days. Subsequently on, a quantitative restriction policy was implemented, forcing beef packers to export only domestic market surpluses.

In 2007, to go along the organisation of "suggested maximum prices" to consumers, the authorities granted subsidies to feed lots to buy corn, policy which continued up to 2011 when the ONCCA was closed, under strong suspicion of corruption.

By 2010–2012, the negative effects of those measures at different levels of the beef concatenation were visible. For example, cattle stock dropped by more than than ten million heads betwixt 2007 and 2012 (severe droughts and floods added significantly to this decline) and domestic cattle cost increased by 300% and beef consumer price past more than than 400% betwixt 2005 and 2012 (IPCVA 2015). Full general aggrandizement rate in Argentina for this menstruum was approximately 319% Footnote 3. Many cattle farms liquidated their cattle stocks and turned to soybean production, and 20% of the number of beef packers closed or suspended their businesses.

The performance did not improve much during 2013 and 2014, with the domestic market absorbing 93.6% of all beef production, the highest pct in 53 years. Production and export connected declining, and an estimated 130 slaughter plants and 15,600 jobs disappeared Footnote 4.

Almost a decade passed since the government intervention began, with various indicators detailing the agin results of such economical policies on the beef sector. Notwithstanding, several questions remain: Would the results had been different without the strong authorities intervention? Would the evolution of sector variables, such as retail prices, consign volumes, quantity produced, and per capita consumption, have been dissimilar without government intervention? What were the costs and benefits of the authorities intervention?

To essay an reply to these questions, this paper aims to estimate the departure of two dissimilar scenarios: ane with actual information of what really happened and some other with a simulated i without government intervention.

This newspaper is structured as follows. In the following section, the time series method used to estimate the model is exposed. So, the results of the model and the estimated impacts of the economic policies applied to the beef sector are calculated. Finally, in the last section, conclusions and implications of the results are presented.

Methods

The VAR model

Given the complexity of the beef market in Argentine republic, information technology is interesting to clarify it from a multivariate perspective. In the analysis of fourth dimension series data, vector motorcar-regression models (VAR) have been widely used in empirical works. The VAR model was proposed by Sims (1980) as an culling to simultaneous equation models. The VAR processes are a generalization of multivariate autoregressive models (AR), where each variable is regressed on a set of others with several lags (Hamilton 1994; Enders 2009).

Following Becketti (2013), a univariate simple model (AR) without exogenous variables tin can be represented every bit

$$ {y}_t=u+{\varnothing}_1{y}_{t-i}+\dots +{\varnothing}_p{y}_{t-p}+{\upepsilon}_t $$

compactly as

$$ \varnothing (L){y}_t=u+{\upepsilon}_t $$

Where y t is a function of a abiding (μ), p past values of t, and a random variable ε t . If we consider a vector together with endogenous variables

$$ {y}_t=\left[\begin{array}{c}\hfill {y}_{1,t}\hfill \\ {}\hfill {y}_{ii,t\ }\hfill \\ {}\hfill {y}_{3,t}\hfill \\ {}\hfill .\hfill \\ {}\hfill .\hfill \\ {}\hfill .\hfill \\ {}\hfill {y}_{n,t}\hfill \end{array}\right] $$

It can be modeled of northward elements every bit a office of n constant, y t past values of the vector p, and a vector of nε t random errors.

$$ {y}_t=u+{\Phi}_1{y}_{t-1}+ \dots +{\Phi}_p{y}_{t-p}+{\epsilon}_t $$

In this equation, μ are the element n abiding vector

$$ \boldsymbol{u}=\left[\begin{array}{c}\hfill {u}_1\hfill \\ {}\hfill {u}_2\hfill \\ {}\hfill .\hfill \\ {}\hfill .\hfill \\ {}\hfill .\hfill \\ {}\hfill {u}_p\hfill \end{assortment}\right] $$

And,Φ I is a matrix of coefficients,

$$ {\varPhi}_i=\left[\begin{assortment}{cccc}\hfill {\phi}_{i,\ eleven}\hfill & \hfill {\phi}_{i,\ 12}\hfill & \hfill \dots \hfill & \hfill {\phi}_{i,\ 1n}\hfill \\ {}\hfill {\phi}_{i,\ 21}\hfill & \hfill {\phi}_{i,22}\hfill & \hfill \dots \hfill & \hfill {\phi}_{i,\ 2n}\hfill \\ {}\hfill .\hfill & \hfill .\hfill & \hfill \dots \hfill & \hfill .\hfill \\ {}\hfill .\hfill & \hfill .\hfill & \hfill \dots \hfill & \hfill .\hfill \\ {}\hfill .\hfill & \hfill .\hfill & \hfill \dots \hfill & \hfill .\hfill \\ {}\hfill {\phi}_{i,\ n1}\hfill & \hfill {\phi}_{i,n2}\hfill & \hfill \dots \hfill & \hfill {\phi}_{i,\ nn}\hfill \stop{array}\correct] $$

And ε t is a vector of due north elements of random errors

where

$$ E\left({\upepsilon}_{\boldsymbol{t}}\correct)=0\kern1em \mathrm{y}\kern1em Eastward\left({\upepsilon}_{\boldsymbol{t}}{\upepsilon}_{\boldsymbol{s}}^{\boldsymbol{\hbox{'}}}\right)=\left\{\begin{array}{c}\hfill \boldsymbol{\Sigma}, \kern1.75em t=s\hfill \\ {}\hfill \mathbf{0},\kern1.75em t\ne s\hfill \terminate{array}\right\} $$

being Σ the variance-covariance matrix. Information technology is important to notation that the elements ε t could be contemporaneous correlated. Also, the VAR model can be written as a VAR with p lags in a more meaty way

$$ \Phi (L)=I-{\Phi}_1(L)-\cdots -{\Phi}_p(L) $$

whereΦ (L) is a matrix of polynomials in the lag operator. The number of lags to include in the VAR model is selected past some data criteria such as Akaike's information criterion (AIC) or Schwarz's Bayesian data benchmark (SBIC). Other tests used to check the adequacy of the VAR model comprise autocorrelation in the residuals (Lagranger multiplier) and a test for normality distribution in the disturbances (Jarque-Bera).

VAR model predictions can be performed direct, which tin be one-period ahead or dynamic. In this work, more interesting results tin be achieved carrying out dynamic predictions over a period ahead.

The variables used in the VAR model are the following: cattle prices (CP), total beef product (BP), per capita beefiness consumption (BC), book of exported beef (EB), and the average retail prices (RP). Two exogenous variables are also added to the model: boilerplate beef export prices (EP) and the domestic soybean prices (SP). Information were obtained from different sources. The cattle prices were obtained from Liniers Footnote 5 cattle marketing in Buenos Aires and expressed in Argentine pesos per kilogram (live weight basis). Total beef product (thousands of tons), per-capita beef consumption (kilograms per person), book of beef exports (thousands of tons), beef prices at the retail level (Arg. pesos/kg), and average beef export prices (US dollar per tons) were obtained from the Found for the Promotion of Argentine Beefiness. Domestic soybean prices were taken from the Rosario Lath of Trade. The data were monthly and comprised the period from January 2003 to May 2014. Footnote vi Although data were bachelor for the mentioned period, VAR model was estimated only for the first years, from January 2003 to March 2006. Information technology responded to the fact that the beefiness market in Argentina operated like a more competitive market during this period. Predictions of the VAR model for this bridge (2003–2006) were then used to compare it with the observed values in the second period (2006–2014) and to estimate the losses or gains resulting from government intervention.

Results and discussion

Scenario with the bodily evolution of selected variables

Descriptive statistics of the main variables included in the model are shown in Table 1 for periods January 2003 to March 2006 and Apr 2006 to May 2014. The price data were deflated to values of June 2013 using the official price index published by the National Establish of Statistical and Census from 2003 to 2006 and so the Consumer Toll Index published past the National Congress of Argentina. The reason of using both indexes is because the official toll index published by the National Institute of Statistical and Census became unreliable after 2007.

Cattle monthly boilerplate toll was higher in the second menstruation (Arg. $8.11/kg.) compared to the first one (Arg.$7.06/kg), with a difference of almost fifteen% between them. Monthly beef product showed similar boilerplate monthly values in both periods and per-capita monthly beefiness consumption just a few differences betwixt both periods (61.78 kg/month, against 63.xiii kg/month). However, at that place were significant differences in the average beefiness exports and retail domestic price for both periods. In beef exports, Argentina exported in average a 27% less in the second period when government controls were in place (2006–2014), and too consumer paid approximately 23% more per kilogram in that menstruation.

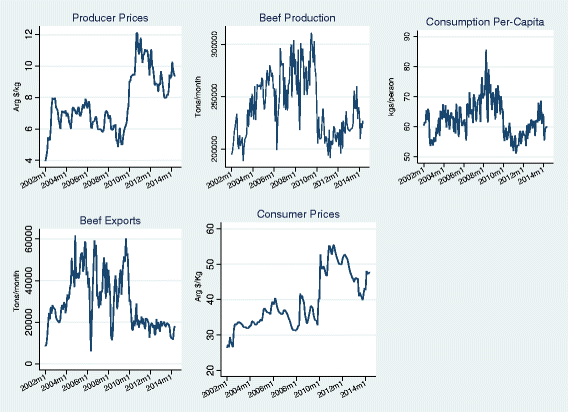

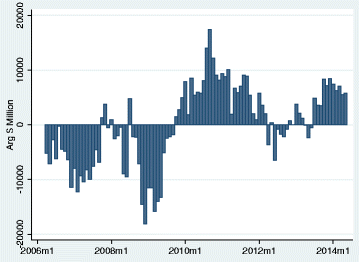

The beliefs of the variables included in the VAR model is shown in Fig. ane. Altogether, they illustrate the present scenario. In all of them, it is possible to observe the significant changes that occurred in the beef sector after 2010, with declines in product, exports, and per-capita consumption. In contrast, it is observed an increase in retail and beefiness cattle prices.

Variables used in VAR model

Results of VAR model

A model VAR of five equations was set with beef cattle price, beef production, per-capita beef consumption, retail beef price, and the volume of beef exports. Taking them equally the beef market place most relevant variables, their interactions allow modelling the market behavior in a reasonable fashion and test the impact of sectorial economic policies. At the aforementioned time, two exogenous variables were added to the model, such every bit beef cuts' prices received past exporters and soybean price. The first was taken as exogenous because Argentine republic is considered a price-taker participant in the international beefiness market. In turn, the soybean price was included because soybean production is seen as an alternative to livestock production in Argentina, competing for resources such equally land and capital letter. Other exogenous variables were initially included in the model, for example, chicken and corn prices, with no pregnant differences in the results. In issue, they were excluded in order to have a more parsimonious model.

The variables were tested for unit roots. Three types of tests are shown in Tabular array 2. The producer toll, per capita consumption and beefiness consign variables were stationaries according to the tests used. All the same, beefiness product and the average retail price only showed evidence of being stationary at the x% level of statistical significance. Consequently, a VAR model with five variables was estimated past the given sample size.

The number of lags in the VAR model was determined according to different selection criteria. A model with iv lags responded to the information Akaike (AIC) and information of Quinn (HQIC) criterion and only iii lags to the Schwarz Bayesian (SBIC) criterion. On this basis, a model with three lags was estimated, since information technology ensured that residuals were uncorrelated, saving degrees of freedom and obtaining a more parsimonious model.

The coefficients of the VAR model for the period January 2003 to March 2006 are shown in Table 3. A total of eighteen coefficients were estimated in the system, including the exogenous variables. The coefficients showed a stationary process since the eigenvalues of the estimated VAR model were located inside the unit of measurement circle.

Many of the VAR model coefficients were non statistically significant. Yet, reducing the lags to ane or ii generated a model with correlated residuals, and the Jarque-Bera test rejected the null hypothesis of normal disturbances on residuals. Testing the lags in each equation of the VAR model, it was constitute that the start lag in the per-capita consumption equation was not significant, likewise as the third lag in the producer toll and export beef equations. However, lags were significant when the VAR model as a whole was considered Footnote 7.

The test of the Lagrange multiplier for residuals indicated no correlation at the 1% level (Table 4).

Moreover, the Jarque-Bera test did non pass up the cipher hypothesis of normal disturbances in all residuals (Table 5).

Based on the estimated coefficients of VAR model for the menstruum 2003–2006, predictions were made in lodge to compare with observed values. Therefore, possible losses or gains generated by the effect of intervention measures were calculated between Apr 2006 and May 2014.

Scenario with predicted results

Predictions based on VAR model

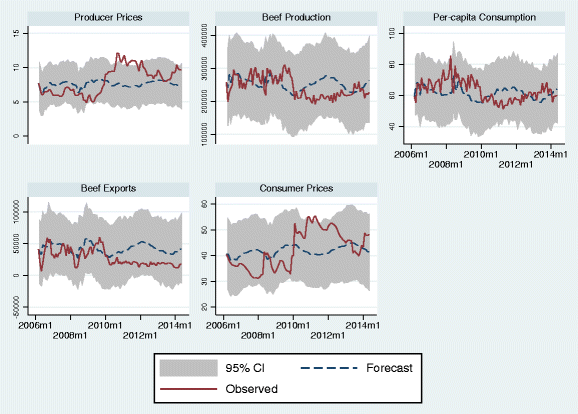

Predictions near the price of the beef cattle started in Apr 2006, afterwards one of the first significant measures imposed by the government banning beef exports for 180 days; prices were shut to those observed. After on, the model did not capture the significant rise that took place in the cattle price, although at the stop of the period, the estimated values were very close to those observed. The gray area shows 95% conviction intervals of dynamic predictions. The observed prices in general remained within this area, except for the unusual rise afterwards the cattle stock liquidation in previous years, which was exacerbated by a astringent flood in the year 2007 and drought in 2009. Forecasts also imply that if the market place had acted more freely, producer prices of beef cattle would had been more stable.

Forecasting beefiness production between 2006 and mid-2009, the model showed similar values to those observed, although with some discrepancies (Fig. 2). Beefiness production would have been greater than the observed data, to reach values shut to those observed for 2014. If we compare the sum of observed values of beef production for the complete period: April 2006 to May 2014, and that of the predicted values, we conclude that production would had been iv.15% college in a market without such authorities intervention.

Dynamic forecasts

The model predicted stable values of per-capita beef consumption, differing from those observed, specially in regard to its variability. In general, consumption forecasts ranged from 52 kg per-capita to 70 kg per capita, showing a slight decreasing trend.

With respect to average retail prices of beef cuts, there are two distinctive periods. Before 2010, the model predicted prices slightly higher than those observed, while subsequently 2010, retail prices were lower. In summary, predicted prices remained with a few changes, with a slight up tendency.

Beefiness export forecasts showed higher values than those actually observed. Between 2006 and up to mid-2009, the exported volumes were slightly college, simply in general close to those observed. However, the exported volumes showed a wider difference for the menses after 2010.

A more detailed analysis of losses and gains on exports, domestic consumption, and producer prices is presented in the next sections.

Losses and gains from the intervention in the beefiness sector

Domestic consumption

Ane of the objectives divers by the government intervention was to keep low domestic prices, particularly for food items. However, results from the model showed that it had a low impact on retail beef price. The average observed retail price was Arg. $42.half-dozen per kilogram, while the predicted without government intervention was Arg. $41.viii per kilogram. This suggests that even with desperate measures such as the barriers and bans to exports, government failed to keep low beef retail price.

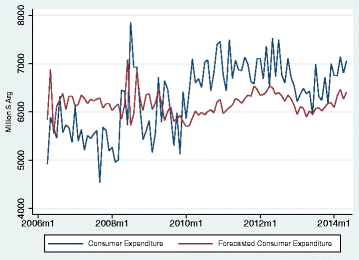

At the same time, an estimation of what it would have been the values paid past consumers given the average monthly prices and the monthly consumption in the domestic market (total production minus full exports) without authorities measures was done. Effigy three shows that bodily consumer expenditure on beefiness compared to the predicted values was lower in the early on years of imposed restrictions only higher after the year 2010.

Total consumer expenditures in the domestic market place

The sum of observed and predicted total consumer expenditures in the domestic market yielded a total value of Arg. $ 14,249 million (U.s.$ 2673 million Footnote 8). It means that the consumer losses were very high, and it confirmed that agricultural policies applied to go on low domestic prices did non accomplish their objective.

Beef exports

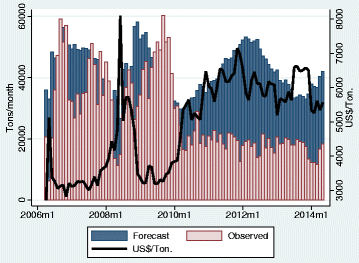

The divergence between beef exports and model predictions under regime intervention for the menstruation 2006–2013 was approximately 1.5 million of tons. This means an average of 180,000 tons per year or nearly 15,000 tons per calendar month. Of those, ane.fourteen million of tons (252,325 tons a month on average) export losses corresponded to the period with a stronger government intervention (2010–2014). Valued at prices received by exporters, the value loss of entire period reached US$ 8000 million, of which US$ 6.800 million belonged to 2010–2014.

Monthly beef exports predicted and observed are showed in Fig. 4, as well as the evolution of boilerplate prices. Losses have been higher subsequently 2010 when the government only authorized exports for approximately 20,000 ton per month, despite prevailing good prices in the international beef markets.

Beef export losses

Producer cattle prices

Predicted cattle prices were higher than observed ones earlier 2010 and lower in the period 2010–2014. Before 2010, a strong cattle supply pushed cattle prices down, and subsequently 2010, the opposite occurred, cattle supply was reduced, increasing prices.

In order to examine whether producers income has been impacted by the interventionist policies, constructive and predicted income values were calculated (total product by cattle prices). For the menstruum 2006–2014, the predicted producer income loss was Arg. $1470 million, which represented almost US$ 275 one thousand thousand. Figure 5 shows a clear difference between the real income and the predicted value by the VAR model before and later 2010. In the first period, the cattle producer sector transferred incomes to other sectors in the production and marketing chain; with the interventionist policies, cattle prices and producer income have been lower than without them. In the second menstruum, existent cattle prices increased more than than predicted and then did producers income.

Difference between observed and predicted beefiness production value

Evaluation of VAR forecast

In lodge to evaluate dynamic forecasts from VAR, nosotros compared the performance of VAR forecasts with predictions generated by other procedures. Three techniques are used to compare to VAR forecasts Footnote nine: (a) unproblematic mean of the variables, (b) predictions from a random walk model, and (c) forecast provided by independent univariate time-series model for each variable of the model (Becketti 2013).

In Table 6, it is displayed the root mean of squared error (RMSE) obtained from pseudo out-of-sample forecasts for each of these methods and for the five endogenous variables of the VAR model. In general, the VAR forecast is an comeback on forecast techniques, especially compared with univariate time-serial models. For producer cost, the relative functioning of the VAR worsen equally the forecast horizon increases, and for two-step-ahead forecast, for example, the RMSE of VAR forecast is 47% smaller than the RMSE of the mean forecast, 34% larger than the RMSE of random walk forecast, and 46% smaller than the RMSE of the univariate AR forecast.

Conclusions

The objective of this paper has been to investigate the impacts of government policies on the beef sector in Argentina, especially evaluating the effects of those measures over some variables such as beef product, producer prices, beef exports, consumer prices, and domestic consumption.

The model used in this work has allowed estimating the theoretical losses generated by government economic measures that influenced beef exports, beef production, producer income, and prices paid by consumers.

Later the 2002 crunch which affected the Argentine economic system, the authorities gradually intensified its intervention in the beef sector. Its main objective was to proceed retail prices depression and, indirectly, its incidence in the CPI. Post-obit years of explicit likewise as bearded control measures, a driblet in cattle stock occurred, past almost 10 1000000 head, as well as in beef exports, while beef consumer price besides increased.

This study revealed that with less government intervention, beef production would have been larger as well as the proportion exported, and producer and consumer prices would accept been more than stable for the analyzed period. This kind of government intervention has had important economic consequences, such as the drop in exports. The model estimated losses of ane.5 one thousand thousand tons of beefiness exports, with an estimated value of 8000 one thousand thousand dollars between the years 2010 and 2014. Decreases have besides been institute in producer income and consumer expenditures.

Lastly, at that place were many others losses which have not been quantified in this work. For case, by non-fulfillment of contracts with buyers abroad, such every bit the Hilton Quota, reputation is a reliable supplier in the international market; jobs lost for meatpackers from a reduction in volumes processed, canceled investments for the negative prospective, reduction in by-products manufactured such as leather articles, and amid others.

Elections were held in Argentina at the cease of 2015, and the new government has adopted some economic and political measures for the evolution of the agri-nutrient sector. These measures included devaluation of the argentine peso, emptying of the consign taxes, and other measures that regulated virtually of the agricultural exports. Therefore, beef product is expected to recover from the erroneous path of the last years and to hold a sustainable growth pattern in the future.

Notes

-

ROE was the registration affidavits for the sales of agricultural products abroad, established by the Argentine authorities with the objective to control agricultural exports.

-

National Office of Agronomical Trade Control (ONCCA) was a regime agency for ensuring compliance with trade rules by operators involved in the market of cattle, meats, grains, and dairy products, in gild to ensure transparency and fairness in the development of the agro-nutrient sector, throughout the territory of the Republic of Argentine republic. It was dissolved by a presidential prescript in February 2011.

-

Aggrandizement rate published by the National Congress from the menstruum 2002–2012

-

The largest cattle market auction in Argentina

-

Data set available from the writer upon request

-

Lags of the VAR model were tested with the STATA command warwle, proposed by Becketti (2013).

-

Boilerplate exchange rate (peso-dollar ) for the whole period was 3.73 Arg.$/dollar

-

The STATA command varbench proposed by Becketti (2013) was used to evaluate VAR Forecasts

References

-

Becketti South (2013) Introduction to time serial using Stata. Stata Press, Lakeway Drive, College Station, Texas

-

COMTRADE (Un) (2016) Database. http://comtrade.un.org/data/

-

Enders W (2009) Applied econometric times series. Wiley, Hoboken, New Jersey

-

Hamilton J (1994) Time series assay. Princeton Academy Printing, Princenton, New Bailiwick of jersey

-

Instituto de Promoción de la Carne Vacuna Argentina (2015) Estadísticas mensuales. http://www.ipcva.com.ar/estadisticas. Accessed 5 Sept 2015

-

Instituto Nacional de Estadísticas y Censos (INDEC) (2012) Agregados macroeconómicos. http://world wide web.indec.gob.ar/nivel4_default.asp?id_tema_1=three&id_tema_2=9&id_tema_3=47

-

Melitsko S, Domínguez A, y Anchorena J (2012) Historia de un fracaso: política de carne vacuna, 2005-2013. Documento de trabajo fundación Pensar, DT012. http://www.fce.austral.edu.ar/aplic/webSIA/webSIA2004.nsf/6905fd7e3ce10eca03256e0b0056c5b9/6884859bae2dd1c603257d740074a1cc/$FILE/CarnevacunaArgentinafracaso.pdf. Accessed x Sept 2015

-

Ministerio de Agroindustria de Argentina (MINIAGRI) (2015) Ministerio de Agroindustria de Argentine republic. Indicadores bovinos anuales 1995-2015. http://www.agroindustria.gob.ar/sitio/areas/bovinos/informes/indicadores/_archivos//000001_Indicadores/000003-Indicadores%20bovinos%20anuales%201990-2015.pdf. Accessed 26 Sept 2016

-

Obschatko E (2012) El sector agroalimentario argentino como motor del crecimiento.http://www.iica.int/Esp/regiones/sur/argentina/Documentos%20de%20la%20Oficina/Cam-Arg-Hol-2013-Alimentar-el-futuro.pdf. Accessed xv Sept 2015

-

Sims C (1980) Macroeconomics and reality. Econometrica 48:1–48

Acknowledgements

This research was supported past funding of National University of Litoral, Argentina, Projection CAID 0416, and funding of Catholic University of Santa Iron.

Authors' contributions

GR conceived the study, collected the information, and estimated the econometric model. EDG and GR drafted the manuscript, and RGA read and made suggestions of the manuscript. All authors read and approved the terminal manuscript.

Competing interests

The authors declare that they have no competing interests.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open up Admission This article is distributed under the terms of the Artistic Eatables Attribution iv.0 International License (http://creativecommons.org/licenses/by/four.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you requite appropriate credit to the original writer(s) and the source, provide a link to the Creative Commons license, and point if changes were made.

Reprints and Permissions

About this article

Cite this article

Rossini, G., Arancibia, R.G. & Guiguet, East.D. Argentine government policies: impacts on the beefiness sector. Agric Econ 5, 1 (2017). https://doi.org/10.1186/s40100-016-0070-9

-

Received:

-

Accustomed:

-

Published:

-

DOI : https://doi.org/10.1186/s40100-016-0070-nine

Keywords

- Argentine beef exports

- VAR model

- Policy impacts

Source: https://agrifoodecon.springeropen.com/articles/10.1186/s40100-016-0070-9

0 Response to "What Continect Is Argentina Located on Who Contols the Price of Beef in Argentina"

Post a Comment